Alabama Department Of Revenue Unclaimed Property

Alabama Unclaimed Property - Official State Website

WELCOME TO ALABAMA UNCLAIMED PROPERTY Each year, unclaimed or abandoned assets are turned over to Alabama Unclaimed Property by financial institutions and businesses that lose contact with the owners. These assets may be in the form of cash, stocks, bonds, insurance benefits or even valuables from safe deposit boxes.

https://alabama.findyourunclaimedproperty.com/

Alabama State Treasury: Home

Each year, unclaimed or abandoned assets--cash, stocks, bonds, insurance benefits, and safe deposit box valuables--are turned over to Alabama Unclaimed Property ...

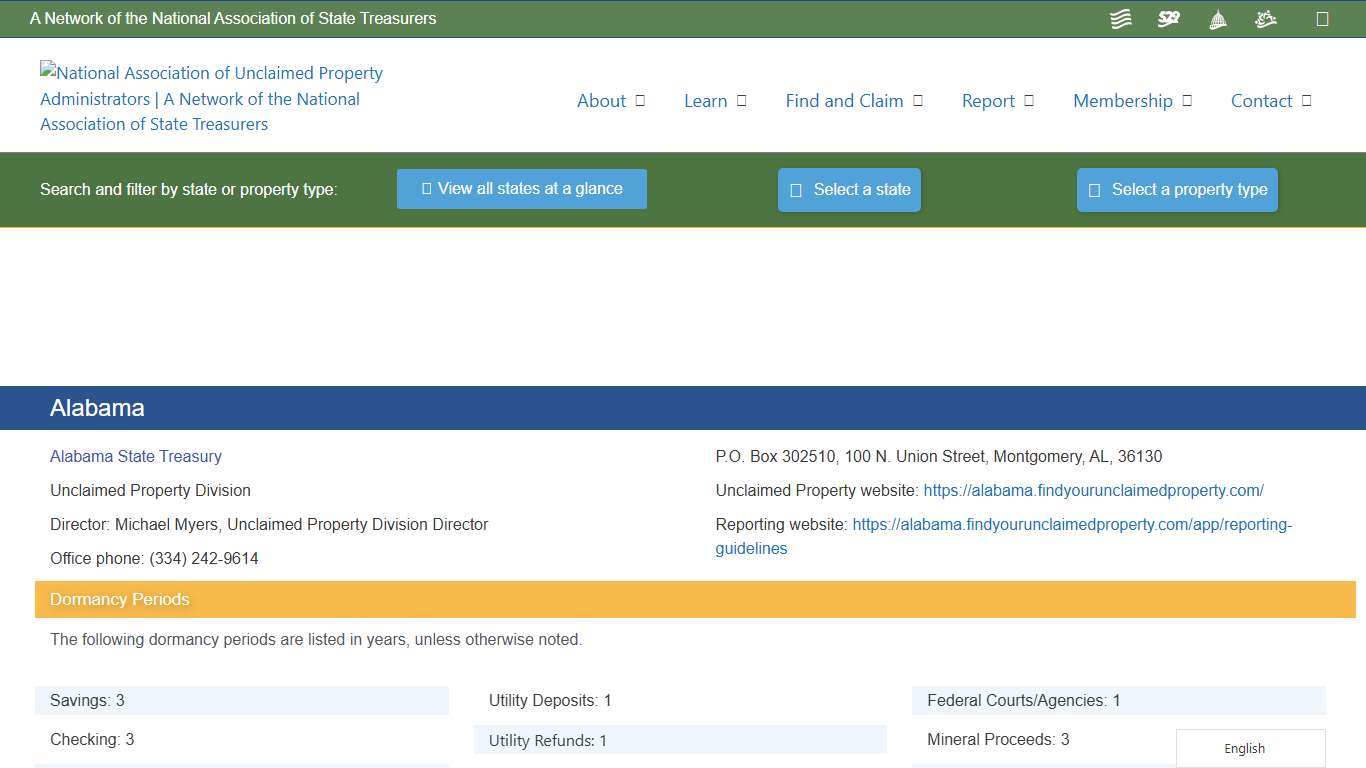

https://treasury.alabama.gov/Alabama – National Association of Unclaimed Property Administrators (NAUPA)

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/alabama/

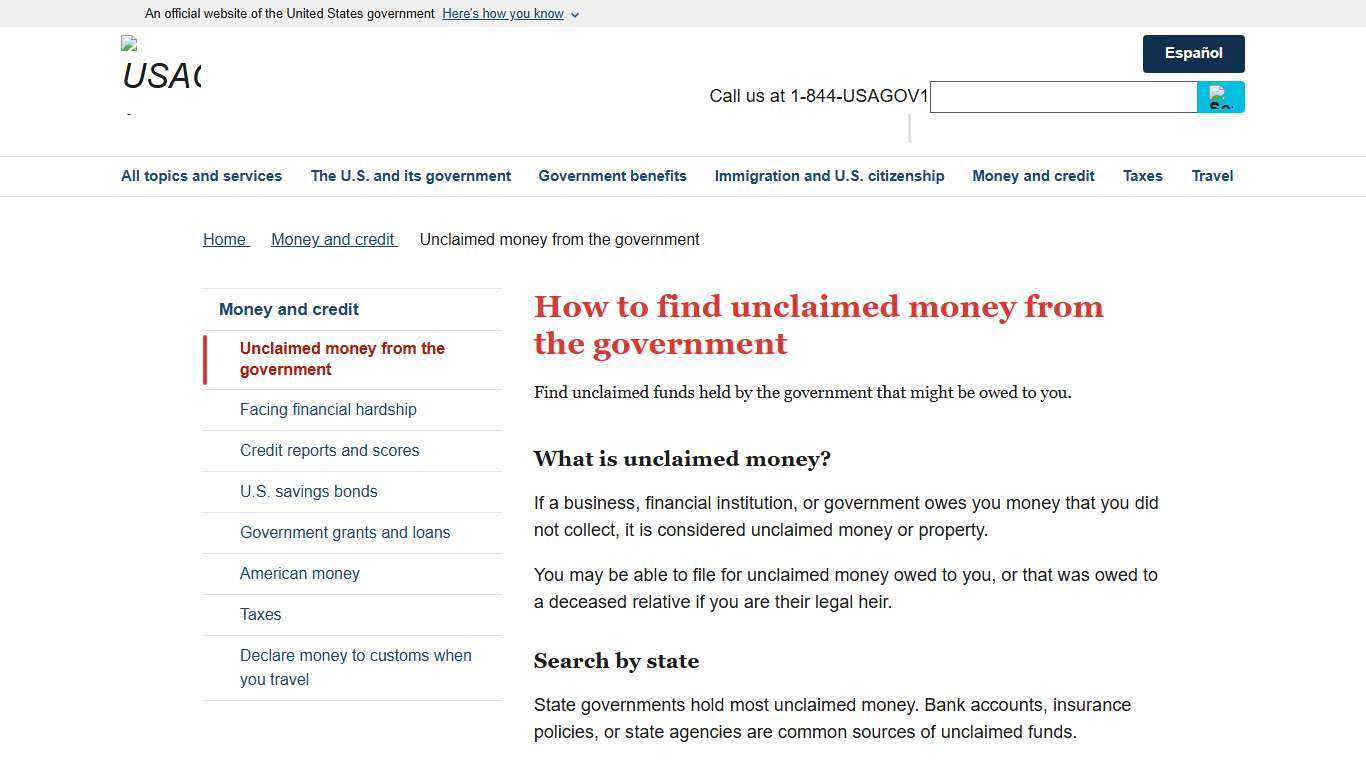

How to find unclaimed money from the government | USAGov

How to find unclaimed money from the government Find unclaimed funds held by the government that might be owed to you. What is unclaimed money? If a business, financial institution, or government owes you money that you did not collect, it is considered unclaimed money or property.

https://www.usa.gov/unclaimed-money

Unclaimed Funds | Northern District of Alabama | United States Bankruptcy Court

Instructions for Filing Application for Payment of Unclaimed Funds Unclaimed funds are held by the court for an individual or entity who is entitled to the money but who has failed to claim ownership of it. The United States Courts, as custodians of such funds, have established policies and procedures for holding, safeguarding, and accounting for the funds.

https://www.alnb.uscourts.gov/unclaimed-funds

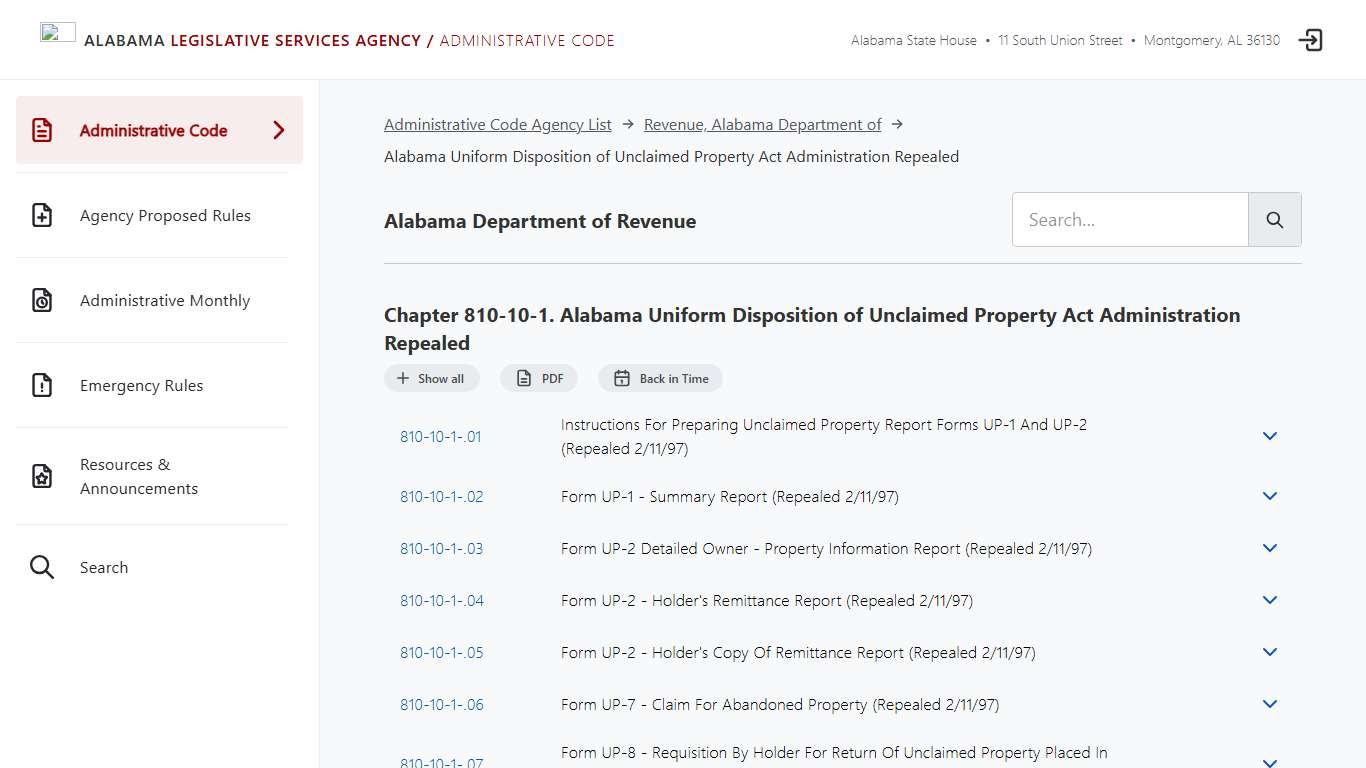

Alabama Administrative Code

The Legislative Services Agency exists to provide non-partisan professional services support to the Alabama Legislature. The Legislative Services Agency was created by Act 2017-214 to provide legal, fiscal, and code revisions services to the Alabama Legislature. The Legislative Services Agency succeeds to and is vested with all of the functions of the Alabama Law Institute, Legislative Fiscal Office, and Legislative Reference Service.

https://admincode.legislature.state.al.us/administrative-code/810-10-1

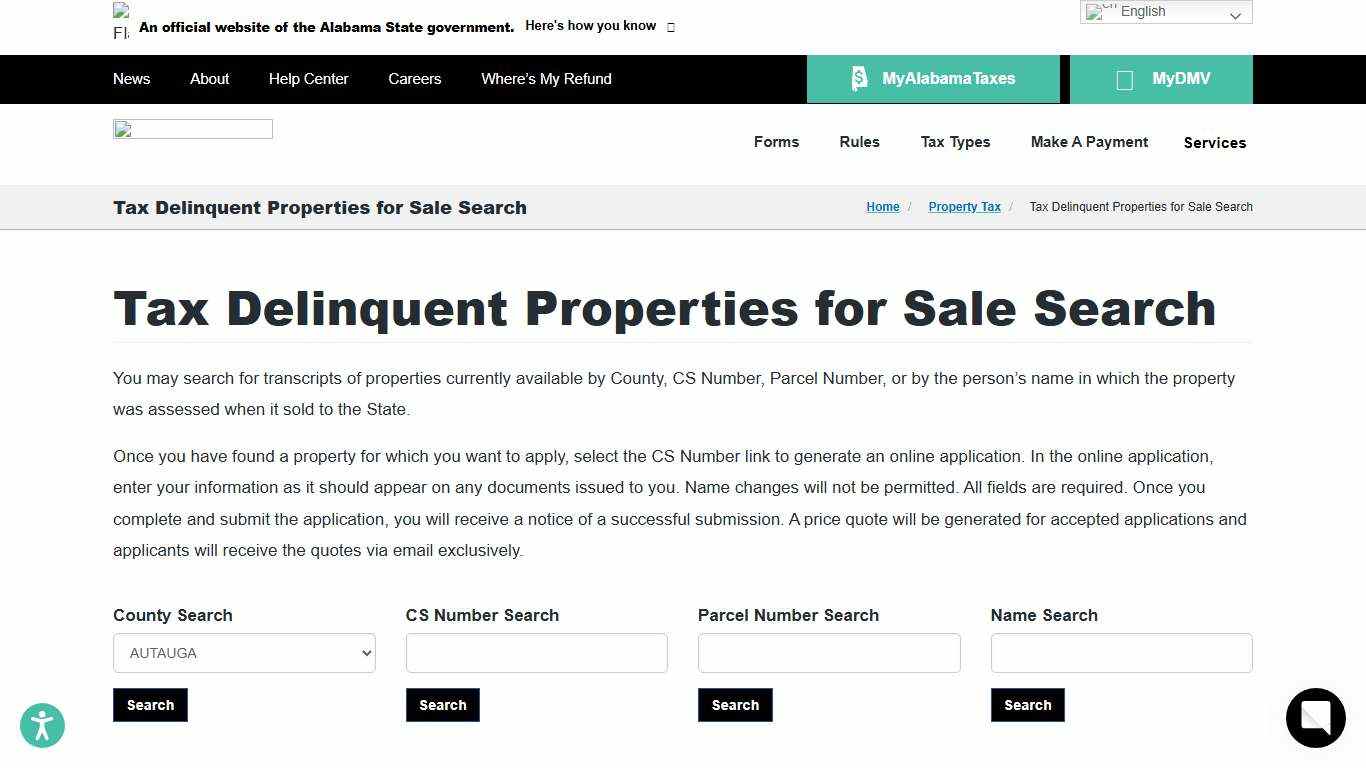

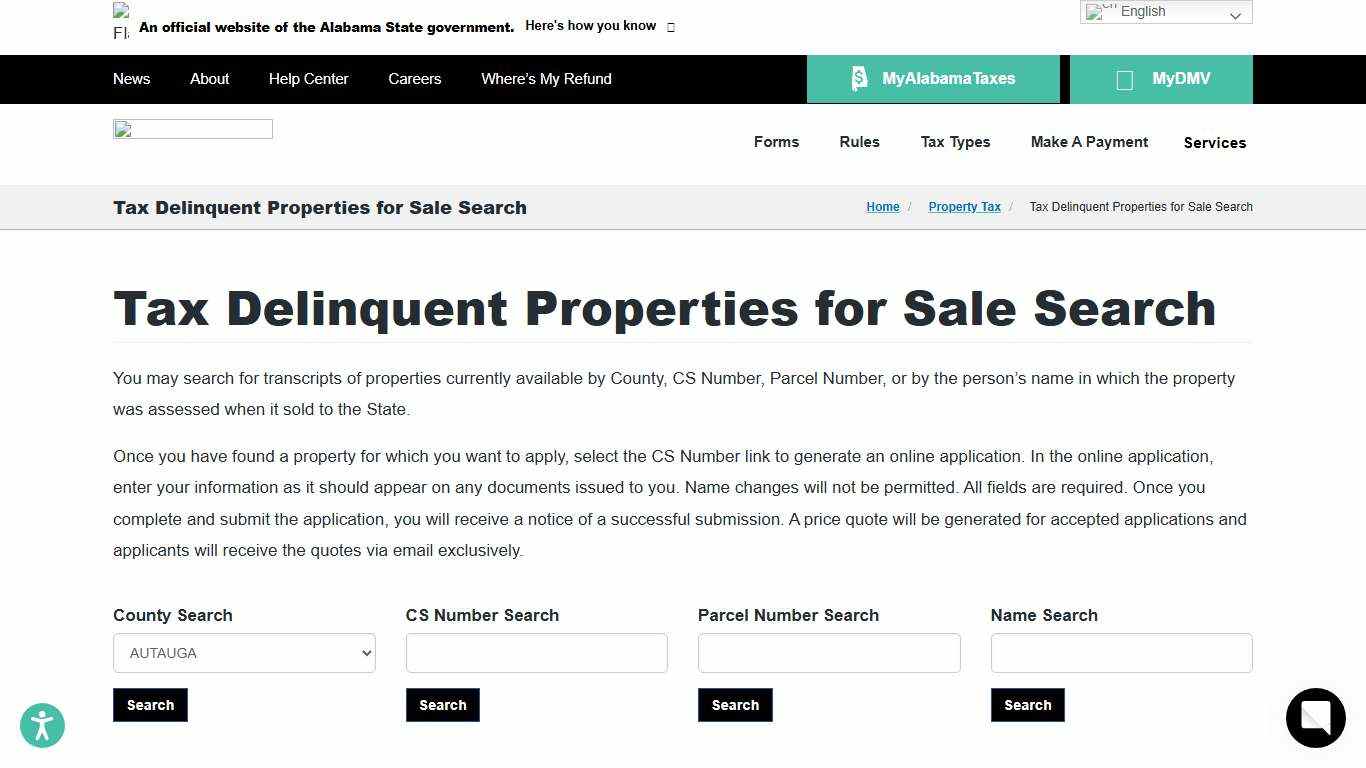

Tax Delinquent Properties for Sale Search - Alabama Department of Revenue

You may search for transcripts of properties currently available by County, CS Number, Parcel Number, or by the person’s name in which the property was assessed when it sold to the State. Once you have found a property for which you want to apply, select the CS Number link to generate an online application.

https://www.revenue.alabama.gov/property-tax/delinquent-search/

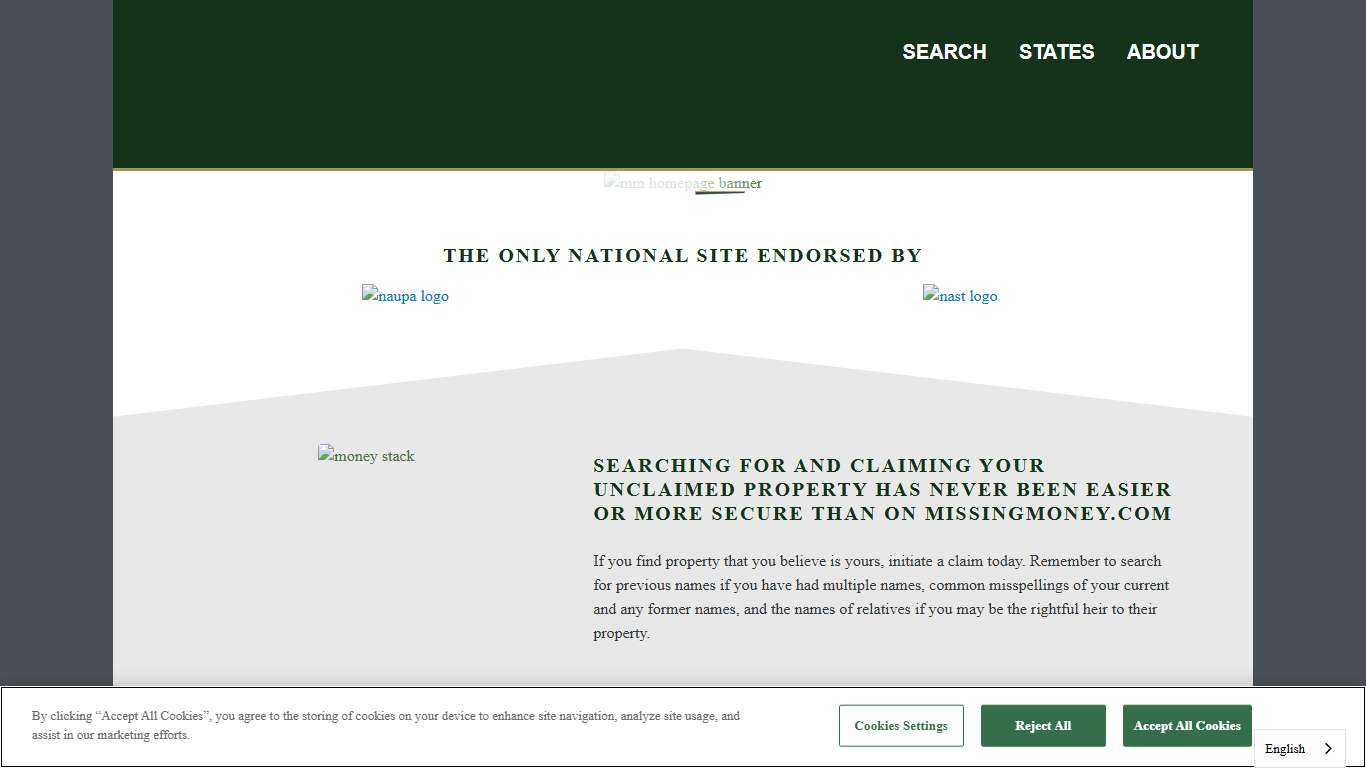

MissingMoney.com | Search for Unclaimed Property

CLAIMING PROPERTY Searching on these fields will assist you in locating unclaimed property and initiating a claim. What is Unclaimed Property? MissingMoney is a FREE and SECURE website endorsed by the National Association of Unclaimed Property Administrators (NAUPA) to search for and claim financial assets that have become inactive and turned over to state unclaimed property programs as required by law for safekeeping.

https://missingmoney.com/

How to find unclaimed money from the government | USAGov

How to find unclaimed money from the government Find unclaimed funds held by the government that might be owed to you. What is unclaimed money? If a business, financial institution, or government owes you money that you did not collect, it is considered unclaimed money or property.

https://www.usa.gov/unclaimed-money

Alabama Escheat & Unclaimed Property Laws | Sovos

The deadline for annual reporting and remittance in Alabama is October 31 for all holders. Early reporting is permitted with prior written approval from the Administrator. All holders have an obligation to report abandoned or unclaimed property to the state in order to maintain compliance with Alabama’s unclaimed property laws and regulations.

https://sovos.com/tax-reporting/unclaimed-property-laws-by-state/alabama/

Tax Delinquent Properties for Sale Search - Alabama Department of Revenue

You may search for transcripts of properties currently available by County, CS Number, Parcel Number, or by the person’s name in which the property was assessed when it sold to the State. Once you have found a property for which you want to apply, select the CS Number link to generate an online application.

https://www.revenue.alabama.gov/property-tax/delinquent-search/

Front page | U.S. Department of the Treasury

Data Center On a daily basis, Treasury publishes Treasury Par Yield Curve Rates, Treasury Par Real Yield Curve Rates, Treasury Bill Rates, Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages. 3.75 3.71 3.69 3.70 3.65 3.61 3.53 3.60 3.68 3.86 4.08 4.30 4.87 4.91...

https://home.treasury.gov/